Enhancing User Experience: Exchange Integrations for In-App Crypto

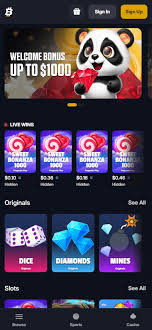

In recent years, the cryptocurrency market has witnessed significant growth, leading to wider adoption and the development of various applications for trading, betting, and investment. With this surge in popularity, the need for seamless exchange integrations into in-app crypto functionalities has become paramount. Developers are striving to offer superior user experiences through efficient transactions, enhanced security, and reliable service. For instance, users engaging in Exchange Integrations for In-App Crypto Purchases Bitfortune betting require instantaneous processes that facilitate quick and safe betting transactions. This article delves into the intricacies of exchange integrations for in-app cryptocurrencies, highlighting their advantages, challenges, and implementation strategies.

The Importance of Exchange Integrations

Exchange integrations serve as a bridge between cryptocurrency wallets and trading platforms, providing users with a streamlined experience. By enabling users to engage in real-time transactions within an application, these integrations eliminate the need for separate platforms, enhancing fluidity and convenience. The importance of such integrations can be summarized as follows:

- Convenience: Users can conduct transactions without leaving the app, reducing friction in the user experience.

- Security: Integrations can leverage the advanced security measures of established exchanges, providing users with additional layers of protection.

- Real-Time Data: Applications can offer real-time trading data, allowing users to make informed decisions quickly.

- Cost Efficiency: Streamlined transaction processes can lead to lower fees and quicker settlement times.

- Wider Access: Integrating various exchanges allows users a broader selection of cryptocurrencies and trading pairs.

Types of Exchange Integrations

There are several approaches developers can take when integrating exchanges into their applications. Understanding the different types can help in selecting the most appropriate strategy for specific use cases:

1. API Integrations

Application Programming Interfaces (APIs) are the most common method for integrating with exchanges. They allow applications to access exchange functionalities, including placing orders, retrieving market data, and managing transactions. While selecting an exchange API, developers should consider factors like:

- Documentation quality

- Rate limits

- Security features

- Supported cryptocurrencies

- Fee structures

2. Webhooks

Webhooks are a way for an application to receive real-time updates from an exchange. For instance, if a trade is executed, webhooks can notify the application immediately, allowing users to stay informed about their transactions without delay.

3. SDKs and Libraries

Software Development Kits (SDKs) and libraries can expedite the integration process. Many exchanges offer ready-to-use SDKs that encapsulate their API functionalities, allowing developers to implement features more easily and reducing the potential for errors.

Challenges of Exchange Integrations

Despite the numerous advantages, integrating cryptocurrency exchanges into applications comes with challenges that developers must navigate:

1. Security Concerns

With the proliferation of cyber threats targeting the cryptocurrency sector, ensuring the security of user transactions and data is critical. Developers must implement robust security measures, including encryption, two-factor authentication, and regular audits to safeguard user information.

2. Regulatory Compliance

Cryptocurrency regulations vary significantly across jurisdictions. Applications integrating exchanges must comply with local laws regarding anti-money laundering (AML) and know your customer (KYC) requirements. Non-compliance can lead to severe penalties and a loss of user trust.

3. Market Volatility

The cryptocurrency market is notoriously volatile, which can affect trade execution and user satisfaction. Developers should implement mechanisms to manage slippage and ensure stable transactions despite price fluctuations.

Best Practices for Successful Integration

To maximize the effectiveness of cryptocurrency exchange integrations, developers should consider the following best practices:

1. User-Centric Design

Building an intuitive interface that guides users through the trading process can enhance usability. Clear instructions, real-time feedback, and user-friendly navigational elements should be prioritized.

2. Extensive Testing

Thorough testing of the integration is essential to identify and resolve issues before launch. This includes testing for performance under load, security vulnerabilities, and user experience flaws.

3. Ongoing Support and Updates

Continuous maintenance of the integration is necessary to keep up with updates from the exchange API, changes in regulations, and advancements in technology. Providing excellent customer support is also crucial to assist users facing difficulties.

Conclusion

As the adoption of cryptocurrency continues to grow, integrating exchanges into mobile applications becomes increasingly vital for improving user experiences. By leveraging effective exchange integrations, developers can offer real-time trading capabilities, enhance security, and provide users with greater convenience. Although challenges exist, following best practices can facilitate the creation of efficient and reliable apps that stand out in the competitive crypto market. Those looking to succeed in the realm of in-app crypto should prioritize exchange integrations as a foundational element of their development strategy.